Women continue to rise

My name is Claudia Moreno and I am the Deputy Executive Director of Fundación Espoir.

Fundación Espoir is an Ecuadorian NGO that specialises in microcredit. Most of our clients work in the informal sector, delivering services or selling food, often on the street. They are mainly women, who are also often the main providers in the household.

Gender equality is a fundamental part of our vision and mission. Latin machismo is proverbial in Latin America. It is rooted in our culture. It lives on in the wage gap, in the difficulties women face every day. But it also pushes women to be better, to move forward, to contribute more, to change the mentality, and to fight against macho prejudice. Despite all the difficulties they face, women continue to rise, go out and fulfil their dreams, contributing to the welfare and future of our country.

We are not free if women are still bound by chains of injustice, inequality, or lack of opportunity.

Claudia Moreno, Deputy Executive Director of Fundación Espoir

That is why 65% of our 398 employees are women. They receive equal pay for equal work. We also have female leadership at the members’ assembly level, in the board of directors, and in executive management. Eighty percent of all supervisory positions in Fundación Espoir are held by women. And I – a woman – am next in line to become CEO.

It was my father who founded the institution and brought the communal banking methodology to Ecuador. He initially worked for an American NGO, called Project Hope, that tackled child mortality. But, when the money ran out, my father realised that both the institution and its clients needed revenues in order to succeed.

Community Banking

Fundación Espoir works with individual credit and community banking, a novelty for Ecuador. We are very proud that this methodology specifically targets the vulnerable in society, such as women.

In the beginning, we exclusively targeted female customers. However, some 10 years ago, we decided to reach out to all vulnerable and underserved segments. So, based on our principles of equity and equality, we opened our business model also to men, who now constitute some 15% of our customers.

Sixty percent of our clients are exclusively ours, either because we are the only financial institution in their region, or because we are the only one willing to provide credit. Our clients are often people without collateral or credit history and for them, collective credit is a way to move forward.

Also, these credit groups are spaces where people feel comfortable and supported to take their lives in hand. That is why many women who are entitled to individual credit still prefer to remain a member of their credit group. Women are excellent workers and can contribute to the economic revival, if you let them. That’s not just empty talk, it’s an institutional conviction. Let this be a lesson to all institutions, public and private, out there: you can be profitable and socially responsible at the same time.

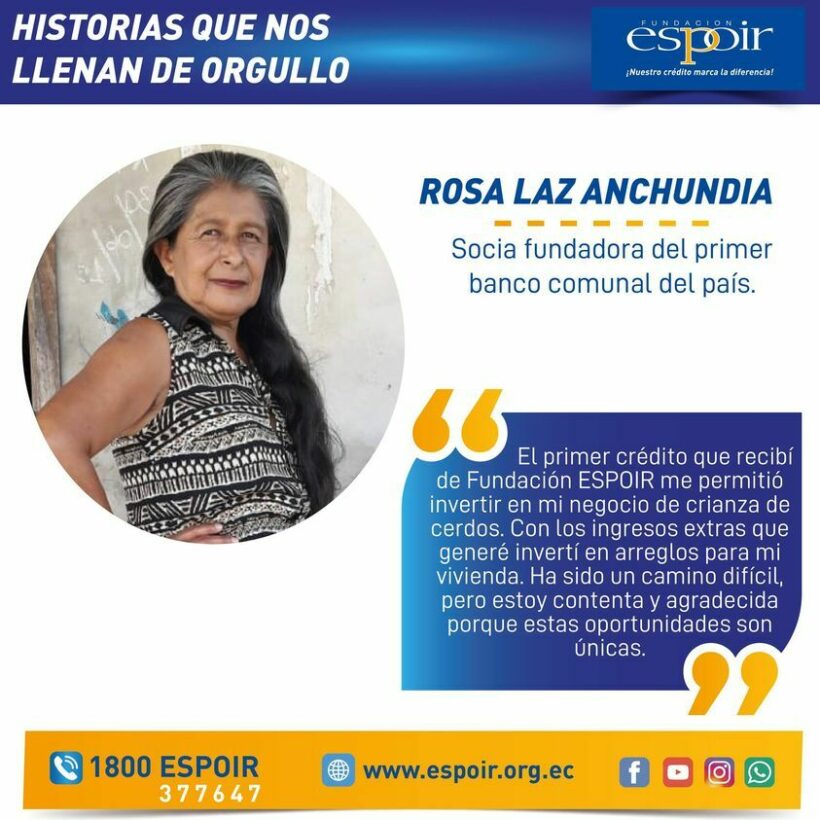

"The first loan I received from Fundación Espoir allowed me to invest in my pig raising business. With the extra income I generated, I invested in home improvements. It has been a difficult road, but I am happy and grateful because these opportunities are unique."

Rosa Laz Anchundia - Founding partner of the first community bank in the country.

Some of our clients still fondly remember their first credit group a quarter-century ago and now even their macho husbands remind them when it’s time to go to their meeting: “Anda, ya tienes tu reunión del banco communal”. These women now have their own business and control their own money. Today, they are owners and managers. Their children go to school and university, which has a long-term impact on their quality of life.

Covid-19

The global pandemic especially affected our poorest customers – and the women. They are usually the first ones to be laid off in times of crisis. Many of them had to stay home to take care of cooking, cleaning, and homeschooling. That is why Fundación Espoir is looking into possible new credit products that may help women to cope with such a crisis situation.

Our enthusiasm is unabated, but I realize there is still a long road ahead. We have logistical problems reaching our communities, and we have capacity issues to accommodate our community meetings while respecting covid-regulations.

Still, we continue fighting the good fight. We are expanding our network and deepening our services. We are also looking at extra funding to develop new products, offer longer grace periods, provide additional financial education, and perhaps even develop insurance products for those who could never dream of being able to afford it.

BIO has invested - through equity, loans and technical assistance - in the Local Currency Microfinance Fund II - LocfundII. This fund has, in turn, invested in Fundación Espoir.

Claudia Moreno is the Deputy Executive Director of Fundación Espoir. This is her story.

Local Currency Microfinance Fund II

-

Debt € 725,111.00 (2014-2022)Latin America and Caribbean, Bolivia, Colombia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Paraguay, Peru

-

Equity € 3,031,680.00 (2013)Latin America and Caribbean, Bolivia, Colombia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Paraguay, Peru

-

Subsidy € 143,535.00 (2019-2023)Latin America and Caribbean, Bolivia, Colombia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Paraguay, Peru

-

Subsidy € 113,688.00 (2014-2018)Latin America and Caribbean, Bolivia, Colombia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Paraguay, Peru

Read our most recent impact stories

Impact story

Angry gorilla

30-08-2024

BIO has invested EUR 3 M in gebana, a company that processes and exports fairtrade and organic fruit and nuts. Oskar is Strategic Projects & Co-Lead Factory Project at gebana. This is his story.

Impact story

Robotics as a service

15-04-2024

BIO invested in USD 5 M in the Omnivore Partners India Fund 2 and USD 5 M in the Omnivore Agritech & Climate Sustainability Fund III, two funds of Omnivore, a venture capital firm. Omnivore invested in Niqo Robotics.

Jaisimh Rao is the CEO and founder of Niqo Robotics. This is his story.

Impact story

Don't shy away from the grey

12-02-2024

My name is Joris Totté. I am the incoming CEO of BIO.

This is my story.