Accommodating the ability to speak

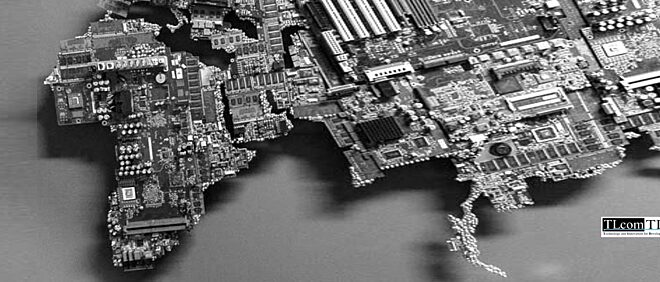

When we are talking about Tech and Innovation in the African context, we are less focused on ‘cutting-edge-tech’ and much more on business model innovation. To us, the most interesting technology start-ups in Africa are about dealing with ‘real-life problems’ and the continent’s biggest challenges, coming up with tech driven and affordable solutions in very big and fast-growing markets.

01-10-2019

It’s about the right business models, about being pragmatic, about in depth understanding of the needs in the market, and above all – about execution.

What role can technology play in Africa and is there room for a fund?

In TLcom’s view there is a lot of space for tech driven innovation in Africa, and this is a super exciting time to have a fund focused on that. With mobile penetration surpassing 70% in most major African markets, of which an increasingly large part smartphones, this platform is more widespread than most of the ‘utility’ services: from banking, to power, to health and so forth. With that in mind, (mobile) technology can be the driver of scalability and affordability for many services both on the consumer and on the business side.

Having been active in the African tech scene since 2006 I can see a clear growth in the quantity and quality of opportunities, with still a great shortage on the capital supply side, creating a great opportunity for a fund like ours.

Is there enough deal flow? Are there enough companies? Are they good enough?

Following the local start-up ecosystems in East, West and South Africa in recent years, we saw a constant increase in the number and quality of new companies started every year, with now hundreds of companies coming onto the market.

Like in any other region, the quality varies, with a majority not ‘Venture Capital investment worthy’. With that in mind, even when applying our usual ‘1%’ investment filter (investing on average in 1 company in over a 100), there are more than enough opportunities for several more funds our size. We are also seeing great quality of founders, with more and more local founders coming into market (and now constituting the majority of the entrepreneurs we meet).

It’s all about business building support

The only visible difference to us between Africa and other tech ecosystems is the relative immaturity of the community supporting these (usually first time) entrepreneurs and start-ups. This is a very young tech ecosystem, and as such, has much less support resources. From mentors to domain experts, real support is much harder to come by. We see our role as true ‘business builders’ rather than as financial investors and spend a lot of our time working with and supporting our founders and companies on both strategy and operations, in their journey to scale and becoming real world-class companies.

Most of our portfolio companies are now scaling moving from start-up to growth stage, from USD 1-2 M to USD 15-25 M of revenue, from teams of 20 to 30 people to teams of 100 to 300 people. Working closely with each of them we try and be very engaged and supportive on all relevant fronts, from strategy to operation, to hiring and to financing.

As part of our focus on supporting a stronger ecosystem, we recently flew in founders and CEOs of our portfolio companies, as well as some not in our portfolio, and spent a day and a half in Nairobi to share challenges and experiences with each other. It was a fantastic day to watch. They were extremely hungry to share and talk with each other. This was not about us teaching them anything, it was about accommodating the ability to connect and learn from each other, benefiting all of us in the long run.

Understanding local needs and markets

Our investment strategy is around tech enabled companies. I think that unlike some of the more mature markets where a lot of the VC investments are about trying to cater for future needs with strong focus on the technology and at times questionable business models, what we come across is much more focused on well defined ‘true’ problems, allowing clarity on monetization from the very start. The fact that there is still much less capital (in absolute and relative terms) for tech in Africa, makes the entrepreneurs laser focused and extremely resourceful, efficient and agile when it comes to growing their startups.

The lack of infrastructure (for example the power grid in Nigeria producing less than 10% of the national demand, or the fact that large areas in Africa are still heavily unbanked) creates some challenges, such as the need to get involved in many parts of the value chain of each sector as the existing industries are less mature. On the other hand, it creates a fantastic environment for tech driven innovation.

One example of a recent investment we made is Twiga Foods based in Kenya. The question of why bananas cost more in Nairobi than in your typical Walmart, while in Kenya they grow a lot closer by and don’t need to be imported by plane, led its founders, Peter and Grant, to launch a company focused on the Agri Supply Value chain. Today, Twiga serves thousands of small street vendors across Nairobi, who can put in their orders on their mobile phone, instead of walking to the wholesale market every morning. The products are delivered to the vendors daily, and by managing the whole supply chain from the farmer to the vendor, Twiga was able to eliminate several levels of middlemen, increasing the price paid to the farmer and lowering the cost for the consumer. With a robust technology platform managing supply and demand, payment cycles and delivery routes, Twiga keeps showing tremendous growth and is one of the fastest growing companies in its sector, employing hundreds of people in Kenya and soon expanding to other markets.

Another of our investments is Kobo360, which can be described in short as an ‘Uber for trucks’. Founded by Obi and Ife, Kobo identified how fragmented the supply market of trucks and logistics is in Nigeria. The company is focused on aggregating and matching supply of truck drivers and owners to demand. Whereas many companies were unable to get their goods out of the port before, they now have a digital platform to manage and trace all their logistics needs. Both drivers and truck owners now get better payment terms, reduced fuel costs, insurance, training and a steady client base that make this a very attractive platform for them to join. Kobo360 is showing an incredible rate of growth and with the concept now proven, it started expanding into Togo, Ghana and Kenya.

Impact

For us, the true driver of impact will be to make these companies global commercial success stories. The way we view it, by the nature of their business, each of them creates a lot jobs and access to previously underserved markets by growing and expanding. The real ‘game changer’, in our view, is to create the first generation of memorable tech companies in Africa, inspiring local youngsters to follow the path, and proving that Africa is on par with, or better than, any other investment destination, thus attracting much more ‘commercial’ capital into Africa’s development, and most importantly, into businesses created locally and serving the true needs of Africa.

Ido joined TLCapital in 2011. TIDE Africa is the first international venture capital fund focused exclusively on technology enabled services and innovation for Sub Saharan Africa (SSA) across all stages of the venture capital cycle.

TIDE Africa Fund

-

Equity € 4,367,820.00 (2019)Sub-Saharan Africa, Kenya, Nigeria

Read our most recent impact stories

Impact story

Robotics as a service

15-04-2024

BIO invested in USD 5 M in the Omnivore Partners India Fund 2 and USD 5 M in the Omnivore Agritech & Climate Sustainability Fund III, two funds of Omnivore, a venture capital firm. Omnivore invested in Niqo Robotics.

Jaisimh Rao is the CEO and founder of Niqo Robotics. This is his story.

Impact story

Don't shy away from the grey

12-02-2024

My name is Joris Totté. I am the incoming CEO of BIO.

This is my story.

Impact story

An illustration of how the world can be

05-12-2023

My name is Tammy Newmark and I am CEO and Managing Partner of EcoEnterprises Fund.

BIO is one of our investors.

This is my story.